Which Of The Following Is A Drawback To Permanent Life Insurance Brainly

Which of the following is a drawback to permanent life insurance brainly. Brainly is the knowledge-sharing community where 350 million students and experts put their heads together to crack their toughest homework questions. Tax-Advantaged Investing A portion of your premium purchases your insurance while the rest earns interest that is not taxable while it remains in your policy. Hope it helps u.

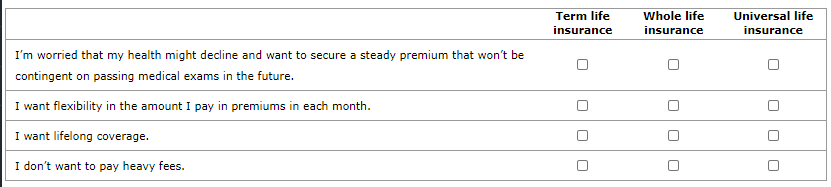

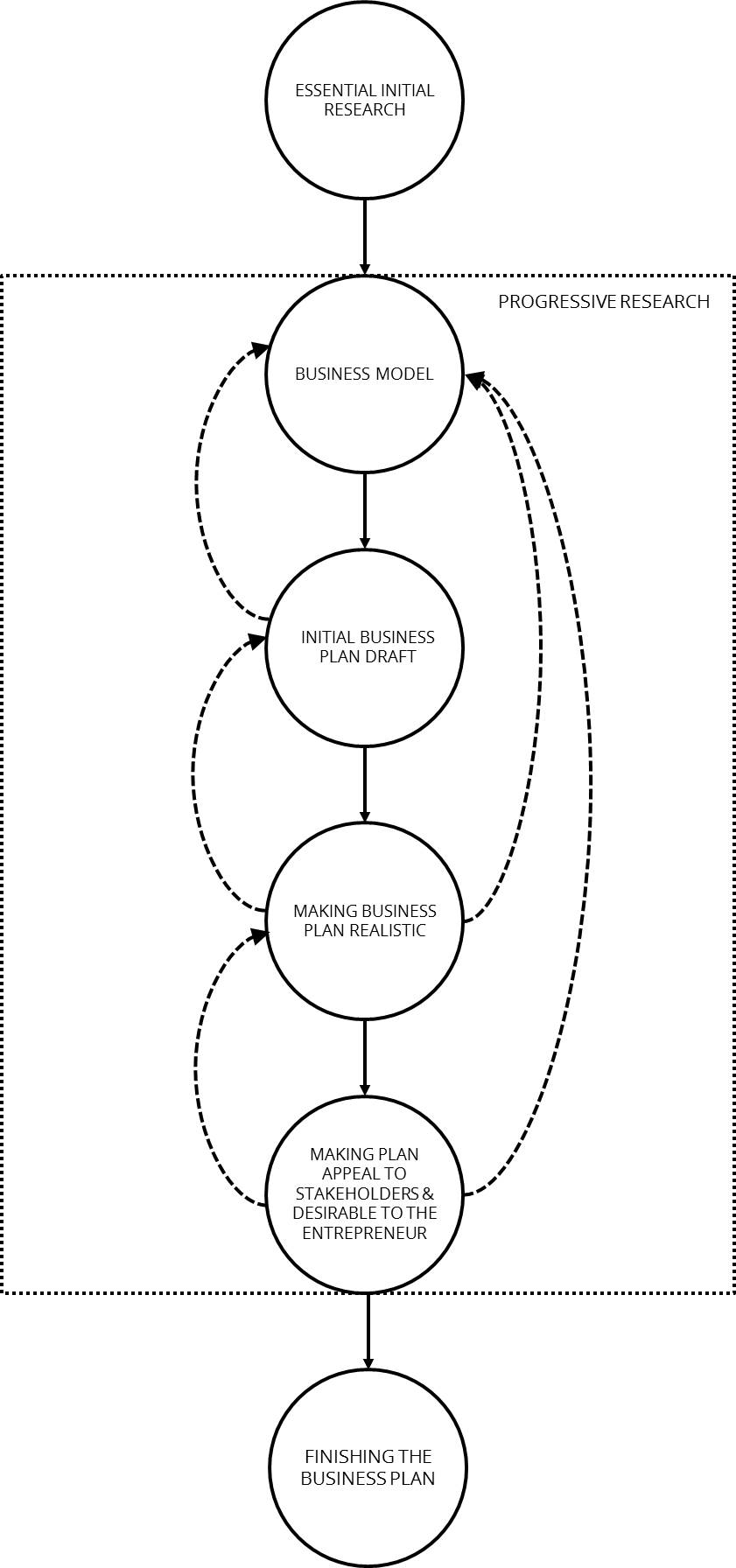

Term life insurance premiums will be lower when compared to permanent policies with the same benefit amount. The drawbacks of universal life insurance include. In addition to a death benefit Permanent Insurance policies usually have a cash value think of it like a savings account that increases over time on a tax-deferred basis which you can invest and borrow.

Get the Brainly App Download iOS App. You may continue with your current policy without taking an exam or proving insurability. Which of the following statements about the waiver-of-premium provision in life insurance is true.

11 Which of the following is an example of permanent life insurance. Life insurance or life assurance especially in the Commonwealth of Nations is a contract between an insurance policy holder and an insurer or assurer where the insurer promises to pay a designated beneficiary a sum of money the benefit in exchange for a premium upon the death of an insured person often the policy holder. 2 The employee and employer may share the cost of the ordinary whole life component.

Which of the following is not a characteristic of permanent life insurance. B Premiums are usually waived if the insured becomes partially disabled. Depending on the contract other events such as terminal illness.

12 _____ policies have no cash value and provide insurance. Google has many special features to help you find exactly what youre looking for. Term will always be less expensive compared to a permanent life insurance policy.

Permanent life insurance is an umbrella term for life insurance policies that do not expire. On a permanent cash value life insurance policy the cash value increases every year.

12 _____ policies have no cash value and provide insurance.

Term insurance is initially much less expensive when compared to permanent life insuranceUnlike most types of permanent insurance term insurance has no cash value. Search the worlds information including webpages images videos and more. D The premium is matched every year to the amount needed to match against death. Yet the assets backing these funds are generally held in longer-term investments thereby earning a higher return. Life insurance or life assurance especially in the Commonwealth of Nations is a contract between an insurance policy holder and an insurer or assurer where the insurer promises to pay a designated beneficiary a sum of money the benefit in exchange for a premium upon the death of an insured person often the policy holder. 11 Which of the following is an example of permanent life insurance. Living benefits are available to the policyholder in the form of cash accrual. 1 The employer pays for the group term component. A Because the probability of becoming disabled exceeds the probability of premature death the cost to include this provision is usually prohibitive at younger ages.

Professional athletes and actresses that have policies for niche markets. Term will always be less expensive compared to a permanent life insurance policy. Ability to access cash value 1. 11 Which of the following is an example of permanent life insurance. Typically permanent life insurance combines a death benefit with a savings portion. Since permanent life insurance policies have much higher rates than term policies and most financial obligations go away over time term life insurance is typically the better option for most people. However if you need lifetime coverage and have the means to pay for permanent coverage it can be a great way to ensure your loved ones are financially protected.

/GettyImages-709133215-59e66d75af5d3a00106c66f6.jpg)

/lifeinsurance_87614098-5c670eaa46e0fb0001a209fe.jpg)

/GettyImages-1176591592-215adf2e23c4422f8f97fb132585cbe2.jpg)

/free-trade-agreement-pros-and-cons-3305845-final-5b71e37f46e0fb002cdbc389.png)

Post a Comment for "Which Of The Following Is A Drawback To Permanent Life Insurance Brainly"